I alluded to God. He said, 'I want a tithe.' He didn't say, 'If you don't have any money, don't give me any tithes,' and he didn't say 'if you're the richest man in the world give me triple tithes,' so proportionality, that's what's really fair. A percentage.

- Ben Carson

[21:1] As he looked up, Jesus saw the rich putting their gifts into the temple treasury. [2] He also saw a poor widow put in two very small copper coins. [3] "I tell you the truth," he said, "this poor widow has put in more than all the others. [4] All these people gave their gifts out of their wealth; but she out of her poverty put in all she had to live on."

Gospel of Luke, Chapter 21, Verses 1-4

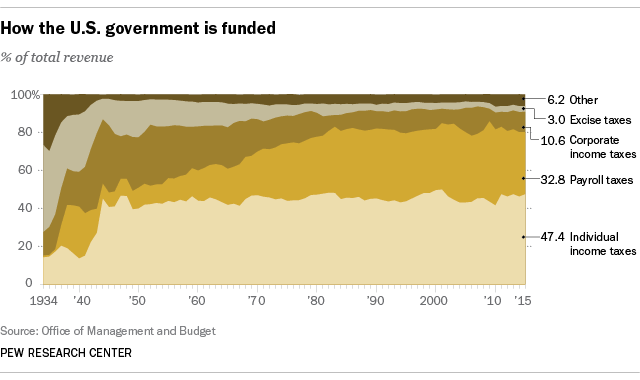

Only 65% of American households end up paying any federal income taxes. The rest of us either don't earn enough to have taxable income or we get our taxes back through credits and deductions, and more than a fifth of non-payers are retirees. When you see videos like the ones linked here from a Fox News anchor or the one quoted from HUD Secretary Ben Carson talking about Americans needing to "have skin in the game" in national tax policy, that's the basis of their argument. So let's take a look at how the government is funded:

This chart is important for two reasons I'll highlight:

- Corporate income taxes are near their all-time low as a % of federal revenue

- Payroll taxes, which are ostensibly split 50/50 between worker and employer, are near their all-time high.

This chart illustrates a quiet but enormous seventy year shift from taxing the company, to taxing the employee. Taxing holders of capital (e.g. estates, corporations), and later taxing income, has been a strategy for stirring economies - for recycling resources to the front of the conveyor - since France and Great Britain started taxing wealthy nobility in the 1700s [Picketty]. As people become rich, they become more likely to get richer, a phenomenon we see today in the fact that for every $5 of income in the United States, $1 goes to the top 1% of earners.

With that accumulation came power unmatched even by associations of other individuals. The momentum they captured transformed families into dynasties. Not only did they accumulate wealth, they held it, and no amount of expenditure or personal investment on the part of a single wealth-holder could deliver the kind of economic expansion needed for broadened prosperity, widespread survival of disease, new technology, new infrastructure, and the array of new human possibility that economies produce.

Leap forward two centuries. The chart above shows that, onward from about 1950, losses in corporate tax revenue have been more or less made up by increases in payroll taxes (the largest two being social security and medicare). That's you. Those payroll taxes have some important characteristics:

- they are not actually split 50/50 between employee and employer; workers tend to pay the employer's share of the tax through wage decreases

- there is no minimum salary threshold: if you're on a payroll, you pay payroll taxes

- there is a maximum salary threshold: earners only pay the tax on the first $120,000 of income, and then 0.9% there onward - in that way the tax is regressive

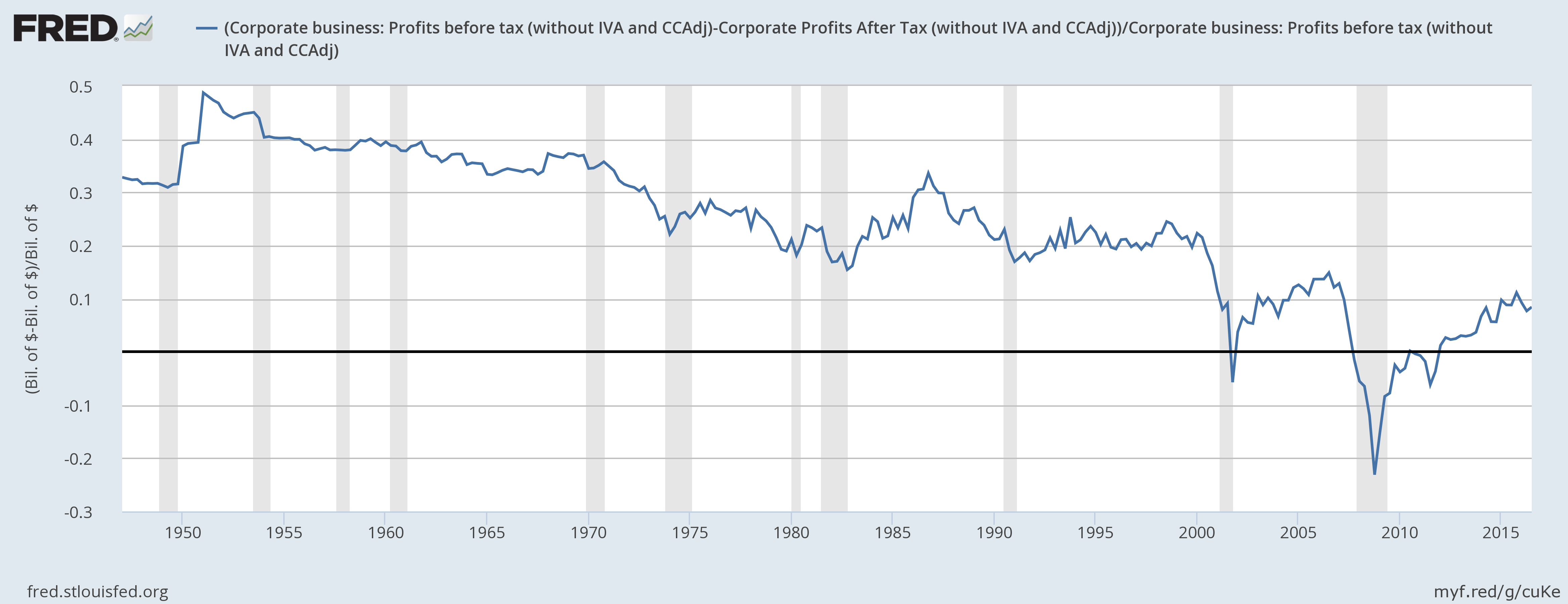

Take a peak at the chart below from the St Louis Federal Reserve. This chart shows that corporate taxes paid as a % of corporate profits are as low as they've been in more than 70 years, outside of recessionary times (recessions = gray vertical lines).

When considered shallowly, taxes are a reduction of potential reinvestment for a company, the devil himself in Tax Collector khaki. In reality, they are a service fee that We the People charge companies in order to use the educational-, informatic-, and human resource infrastructure that We the People have built to facilitate their business. That means that we are all in the business of dialing in our tax code to ensure that we're encouraging business growth on the one hand, while not overburdening the working class to a point of immobility, nor stealing future national progress by cutting out the knees of public education.

President Trump recently foretold of "big league" relief for tax-abused corporations. Phil Davis - a professional investor and Wall Street commentator who's known for his options prowess - made this point Tuesday, commenting on the $20 trillion current and record valuation of the S&P 500 - the market index based on the earnings of America's 500 largest public companies:

"$20,000,000,000,000!

That's a lot of money. They claim the forward p/e of the 500 companies that make up the S&P 500 is only 20 - based on growth expectations, tax breaks, etc. That would be $1 TRILLION in earnings for just 500 companies and the S&P 500 is about 1/3 of the total US Markets so $60Tn and $3Tn in earnings for our mighty US stocks is very nice.It takes barely three google strokes to learn that in the context of our own history, theories on Uncle Sam's exploitation (read: "our exploitation") of American corporations don't hold water.

Why then, do these companies pay just $341Bn in taxes? That's only 11%. Why is it the top priority of the Trump Administration to LOWER Corporate Tax Rates so they can pay less and you can pay more. Why are we providing stimulus to Corporations, why are we taking away their regulations when they are underpaying their taxes by 66%? "

It is representative of our day, I think, that Ben Carson reads the verse from Luke as a proxy argument for the wealthiest class in world history to be dealt a fairer hand. It feels like a snaky play to a common thread in American households who give religiously to their churches and would admonish others to do likewise. And good for them (!), I hope they continue.

But, short of litigating the gospels, the writer of Luke does us a favor in pointing out the problem of concluding that considering "percentages" among households making even $60,000 a year versus households making north of $200,000 makes for fairness.

The woman paid out of her poverty. The little bit she gave came from what she needed elsewhere. Jesus didn't point to it and say, "now that's good tax policy, let's get that down on paper." He called it blessed sacrifice, not short of canonical. When a family making $60,000 a year - having maybe $45,000 of taxable income - pays their effective rate of ~15% they're not paying out of their poverty, but they are making smaller contributions to college funds or car payments or buying cheaper less healthy foods, on average they have no savings for retirement and with the repeal of ObamaCare / ACA their health insurance is likely to get more expensive or go away. Their tax burden comes out of a pool of money needed elsewhere. Percentages at this altitude are deceptive.

Congress and President Trump are about to propose a tax plan to the nation that will reduce the corporate share of federal revenues from levels already as low as they've been in three generations, while slightly raising or holding steady the middle class rates and cutting programming. It is also set to lower the share of federal revenues from America's top earners - like S&P 500 CEOs, whose average yearly income is more than 200x that of their average worker.

Somehow in the muddle, in the soup of chronic campaigning made playground to twisted-up and contagious half-truths, Americans emerge believing that the problem is middle- and low-income fiscal grinches, unwilling to get off their caboose and contribute.

For the moment, I'm stumped when it comes to the social travails we find ourselves in. Those divergences require different sanctuaries than this one to be inspected and reconciled. What I hope is that working class folks - the most vulnerable to economic shock - understand the sorts of systemic changes President Trump and the current Congress have in the pipeline, very openly designed to insulate the most fortunate in the United States from mechanisms meant to help pay for the country's stable progress. Average Americans should have skin in the game; we should all point to the pound of flesh already given.

=======

- Post Script -

The natural rebuttal goes like this: American tax rates make us uncompetitive internationally. And that would be true if we were to imagine ourselves competing with the likes of Ireland or the Cayman Islands, who are respectively being sued by the European Union in tax avoidance, and have a standing invitation as the butt of all finance jokes. Compared to other large economies in the developed world, however, our effective tax rates run somewhere near the middle of the pack. Simplification of the code warrants our attention, as small businesses without the tax avoidance might of fiscal gymnasts at Exxon or Apple somehow are left by their representatives in Congress at the losing end of our tax policy. But that's for another time.

* "large companies" implies an enterprise value of $10 million or more

There’s a great deal wrong with Carson’s thinking here. 1. What the widow is contributing into the temple treasury has nothing to do with what she paid in taxes. The Roman tax system was even more regressive than ours. The money this woman is giving will go for the welfare of others, not for the building of the Roman Empire. 2. There was an expectation that the wealthy would care for those in need. That’s why Luke tells the story of the Rich Man and Lazarus Luke 16:19-31). Lazarus lay at the gate of the Rich Man because the whole society expected that he would be cared for by the ones who had means. That’s why the Rich Man goes into torment…he’s failed to care for Lazarus. In the story, his greed has consequences beyond this life. 3. The only time Jesus uses the word “tithe” is in words of condemnation for those who neglect the needy Luke 11.42: “But woe to you Pharisees! For you tithe mint and rue and herbs of all kinds, and neglect justice and the love of God; it is these you ought to have practiced, without neglecting the others.”

ReplyDeleteWow, thanks for commenting Dad. That'd have been a better way to go with this piece! You should write that.

DeleteYour piece is right on. I just added a little breadth.

ReplyDeleteGreat piece, Erik.

ReplyDeletehell. yes.

ReplyDelete